December was the first post-retirement month. I am changing the layout of these reports to remove investment performance over the last five years and add in the income and spending report I dropped back in 2018. This is because I have a new focus on making sure spending stays within our budget, whereas it is hard to change investment performance over a five year period on a monthly basis. I will report on longer term investment performance in the annual review as usual.

In December, the Australian Dollar rose from USD 0.6550 to USD 0.6674 meaning that USD investment returns are better than AUD investment returns. We had a good month in terms of investment return. Stock markets were slightly up with a lot of intramonth volatility (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 1.07%

S&P 500: 0.06%

HFRI Hedge Fund Index: 0.26% (forecast)

Australian Dollar Benchmarks

ASX 200: 1.36%

Target Portfolio: -0.19% (forecast - depends on HFRI result)

Australian 60/40 benchmark: 0.22%

We gained 1.28% in Australian Dollar terms or 3.28% in US Dollar terms. So we outperformed all benchmarks apart from the ASX 200, which we got fairly close to. These returns are preliminary, as we won't get results from Aura Venture for more than a month, and Angellist report with a three month lag. I was curious about how much I end up revising my monthly performance figures when all the data is available. Here are the results for the last year:

"Original" is the rate of return reported in this blog and "Current" is my current estimate. In the last year, on average I overestimated the rate of return initially. On the other hand, I initially underestimated the return for last December but as you can see I have already trimmed this December's number a little.The SMSF again outperformed, returning 0.62% beating Unisuper (0.37%) and PSS(AP) (0.40%).

Here is a report on the performance of investments by asset class:

Things that worked well this month:

- As mentioned above, most hedge funds did well with Tribeca Global Resources (TGF.AX) gaining AUD 42k and Regal Investment Fund (RF1.AX) 17k. Gold, 3i (III.L), and Cadence Opportunities (CDO.AX) all gained between AUD 9 and 10k.

What really didn't work:

- Only five investments lost money and no investment lost more than AUD 10k.

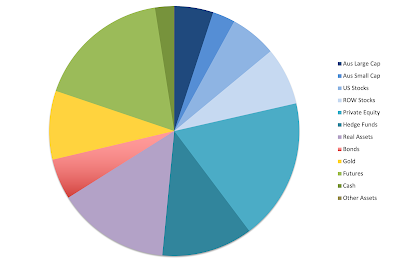

We moved towards our target allocation. Our actual allocation currently looks like this:

About 65% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily liquidity, so our portfolio is not as illiquid as you might think.

Moominmama receives employer superannuation contributions every two weeks. We also make monthly concessional contributions to Moominmama's superannuation to reach the annual cap on contributions. I made the last USD 10k contribution to the Unpopular Ventures Rolling Fund this month. There will still be capital calls from Aura Venture Fund II and III. I am receiving monthly TTR pension payments from both Unisuper and our SMSF. I will decide how much to recontribute to superannuation later in the financial year.

This was a quieter month in terms of transactions:

- I sold 5k WAM Capital (WAM.AX) shares.

- I bought net 1k shares of WCM Global Quality (WCMQ.AX).

- I sold 250 Perth Mint Gold ETF (PMGOLD.AX) shares.

- I sold all our position in WAM Strategic Value (WAR.AX, 100k shares) in order to fund the 1:1 entitlement offer for the L1 Global Long Short Fund (GLS.AX, formerly Platinum Capital, 85k new shares).

Here are the income and spending accounts for this month:

Results are shown separately for retirement and non-retirement accounts as well as housing, which nowadays doesn't have much activity. The grey lines are additional notes. Total investment income is split into investment income before exchange rate moves and the contribution of exchange rates. Other income is non-investment income including salaries, employer superannuation contributions, and net tax returns. Investment income is shown pre-tax. Tax credits include franking credits on Australian Dividends and imputed tax on superannuation returns. These are taken away from investment income to get changes in actual net worth. Inheritances include gifts from relatives. Saving is from non-investment income, transfers, and inheritances.

This month, salary hit a record number as I received the redundancy payment of more than AUD 1/4 million. Spending was fairly average at AUD 12k. There was a larger than normal transfer out of superannuation as I made excess concessional superannuation contributions in the previous tax year, which I withdrew from Unisuper. We received a cash gift from Muminmama's father (counted as inheritance). As a result of all this, net worth increased by AUD 347k, almost all of it in non-retirement accounts. Now, I will have to decide how much to contribute to superannuation. I want to hit the goal of transferring AUD 2 million to a tax free pension account. I also want to max out the concessional contribution cap of AUD 30k for this year to help reduce my taxes, which will be very high because of the redundancy payment. The payment itself has low taxes but it pushes most of the rest of my income into the top tax bracket.

To keep things simple, I will use net worth at the end of this month as the "retirement number". Net worth at the end of December not including our house is AUD 6.875 million. Using the 4% rule means we could dissave AUD 275k per annum. Our spending is a lot below that. Total net worth is AUD 8.112 million.